New Pricing System

Setting

General price-setting in many industries, like for instance the automotive industry is rather straight forward: prices are set for the duration of the project (e.g. 5-7 years) with a yearly ‘learning-curve’ reduction. Where (spot) prices of certain ingredients tend to be volatile, e.g. enamelled copper wire, hedging is used. Hedging however was (and still is) no option for the price drivers in Nd magnets. These rare-earths (e.g. Nd, Dy, Pr, Ga) are mostly delved in a few regions in China and only know spot prices. For very many years this had not been a problem, there was little volatility and what there was, was most mostly downwards. As a result, even in the absence of hedging, prices were fixed for the duration of a project.

Challenge

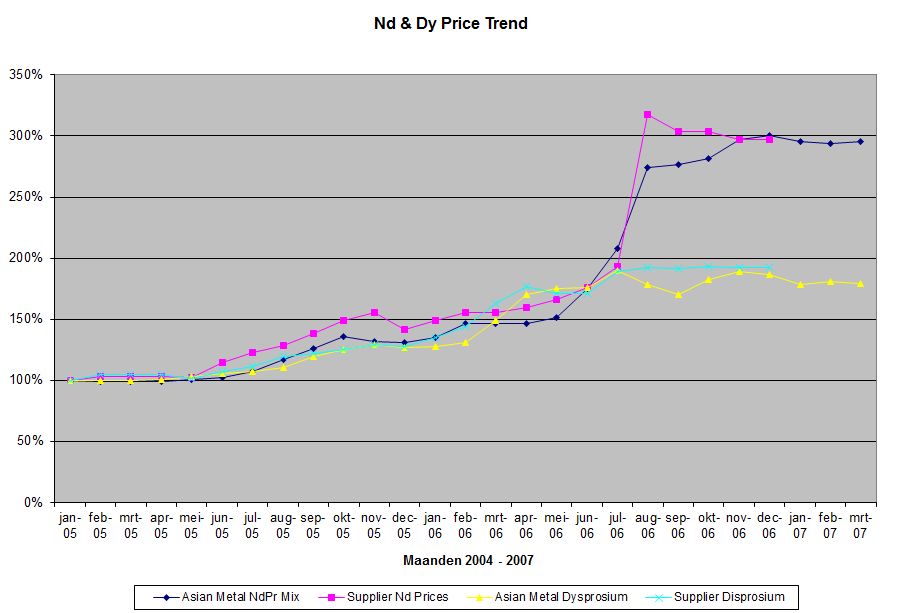

In 2005/2006 the impossible suddenly happened: the price of the main ingredients Neodymium (Nd) and Dysprosium (Dy), constituting some 25-35% of the product, started to increase: By September 2005 they were 25% more expensive than at the beginning of the year, 6 months later it was 50% and the rise continued. Something needed to be done, our gross margins were long since wiped out.

A complicating factor was that there were no trusted independent sources like the London Metal Exchange. I could only find a Chinese (then) start-up that quoted, on a rickety website, similar metals on a weekly basis. I thus needed to convince our clients of:

- The need to create a new pricing system that allowed for frequent updates

- The fact that this in those days less than professional looking site was trustworthy and

- The metals they quoted had bearing on the metals we

Solution

I convinced our supplier to hand over their raw material invoices for 2005 and the first months of 2006 and plotted their trend against the trend of several metals quoted.

I convinced our supplier to hand over their raw material invoices for 2005/2006 and plotted their trend against the trend of several metals quoted. An analysis of these 24 months identified the relevant metals which followed closely the actual raw material trend; to be more precise, the indices found generally showed lower pricing than those actually paid, as such we erred in favour of our customers.With the promise that we would continue this tracking system for at least another 12 months, I persuaded our clients to move to a quarterly price adjustment, where the average metal price of the last 3 months would determine the price for the next 3 months.

This system was subsequently adopted by all our competitors.

See also: