and then, Breaking Them Open

Setting

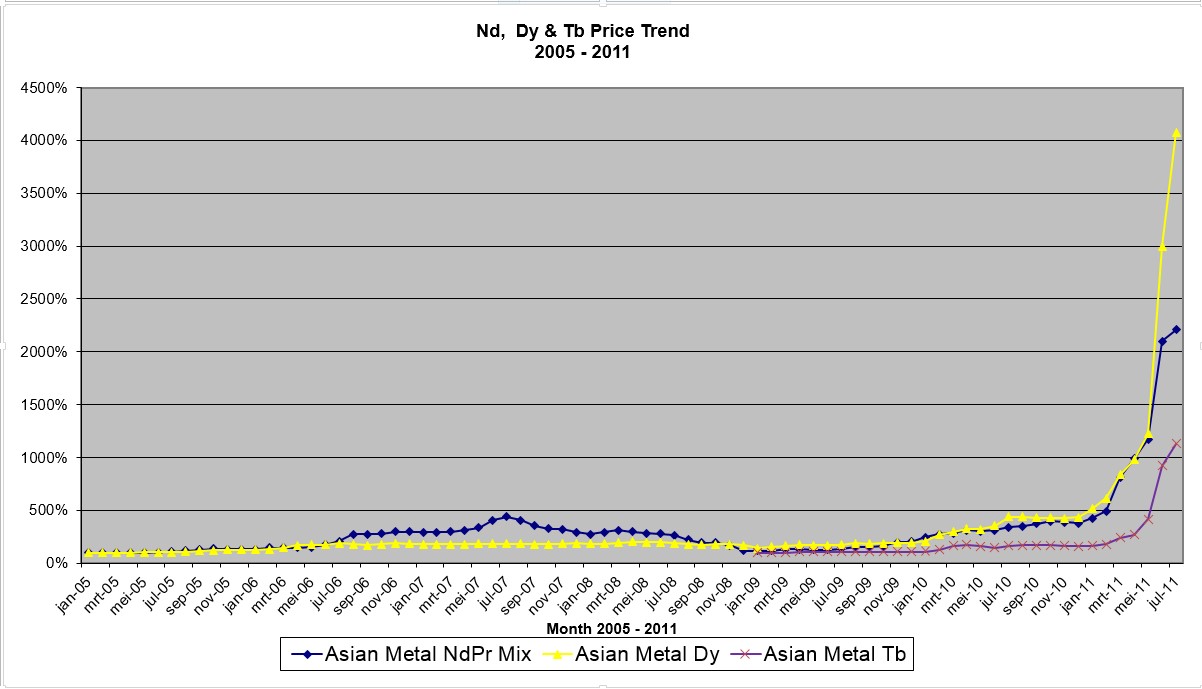

Our main product, Neodymium magnets, is an alloy with a substantial share of rare earth materials (>30%), making their individual prices a major factor in the ultimate selling price. It was for this reason that I had created a quarterly price mechanism and had managed to make this mechanism a standard part of our long-term contracts (an industry first). We thus believed we had more than sufficiently limited this risk; events in 2011 however proved us wrong.

Challenge

Up to that moment prices had been relatively stable, taking well over 6 months to at most double or halve as the case might be: the mechanism was easily coping. No-one however foresaw the 2011 upheaval: Prices of rare earth materials went through the roof with prices doubling in less than a month and some even showing a 9-fold increase in less than 6 months. Our purchase prices were suddenly adjusted monthly and based on the latest raw material pricing; quarterly updates of sales prices based on averages were obviously no longer possible, they would lead to a loss of several million Euros per month!

You might want to compare this graph with the 2006 graph (the tiny blue bubble in the middle of this graph and then reason to introduce our quarterly price system))

Solution

There was therefore only one option open to us: break the contracts open and enter into new contracts with a very much more flexible pricing mechanism: the quarterly system would be default, however exceptional circumstances would allow for exceptional adjustments. It was again my task to accomplish this, forcing our customers to absorb the losses we could not and again, although with a lot more heartache, I was successful, saving the company

See also: